jefferson parish property tax 2020

Jefferson Parish residents receiving sticker shock at property tax bills. KNIGHT LISA KNIGHT AND TROY DEMOND KNIGHT AKA TROY D.

Ad Search County Records in Your State to Find the Property Tax on Any Address.

. 504-363-5500 Police Fire Medical. 2021 Plantation Estates Fee 50000. Join us at this town hall on.

JEFFERSON LA The Jefferson Parish Adjudicated real estate auction scheduled for August. The total assessed value of all property in the parish which also includes utilities and certain commercial fixtures and equipment was 396 billion up about 3 from 383. Jefferson Parish Sheriffs Office 1233 Westbank Expressway Harvey LA 70058 Administration Mon-Fri 800 am-400 pm Ph.

If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to. Enter an Address to Receive a Complete Property Report with Tax Assessments More. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street.

Jefferson Parish Property Records are real estate documents that contain information related to real property in Jefferson Parish Louisiana. Jefferson Parish Wards. VS LISA MARIE KNIGHT AKA LISA M.

Adjudicated Property Auction to be Held Online on August 15 August 19 2020. These taxes may be remitted via mail hand-delivery or filed and paid online via our website. Enter an Address to Receive a Complete Property Report with Tax Assessments More.

Tangible Property Tax Credit Status The Site is not located in. Public Property Records provide information on. A coalition of community groups has been exploring possible solutions including a partial property tax exemption for income-qualified homeowners.

Once the preliminary roll has been approved by the Louisiana Tax Commission the 2021 assessments will be updated on the website. The total number of parcels both commercial and residential is 185245. BANK OF AMERICA NA.

The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection law enforcement education recreation and other functions. On December 11 2021 voters in Jefferson Parish will decide whether to renew two property tax millages on the ballot that directly impact the quality of life for Jefferson Parish residents. WVUE - A couple of days ago Jefferson Parish resident Veeda Payne.

2020 property tax notices to Jefferson Parish residents and businesses by Monday December 7 2020. Ad Search County Records in Your State to Find the Property Tax on Any Address. Jefferson Parish collects on average 043 of a propertys.

In order to redeem the former owner must pay Jefferson Parish 12 per annum 5 on the amount the winning bidder paid to purchase the property at the Jefferson Parish Tax Deeds. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

Louisiana Amendment 5 Payments In Lieu Of Property Taxes Option Arklatexhomepage

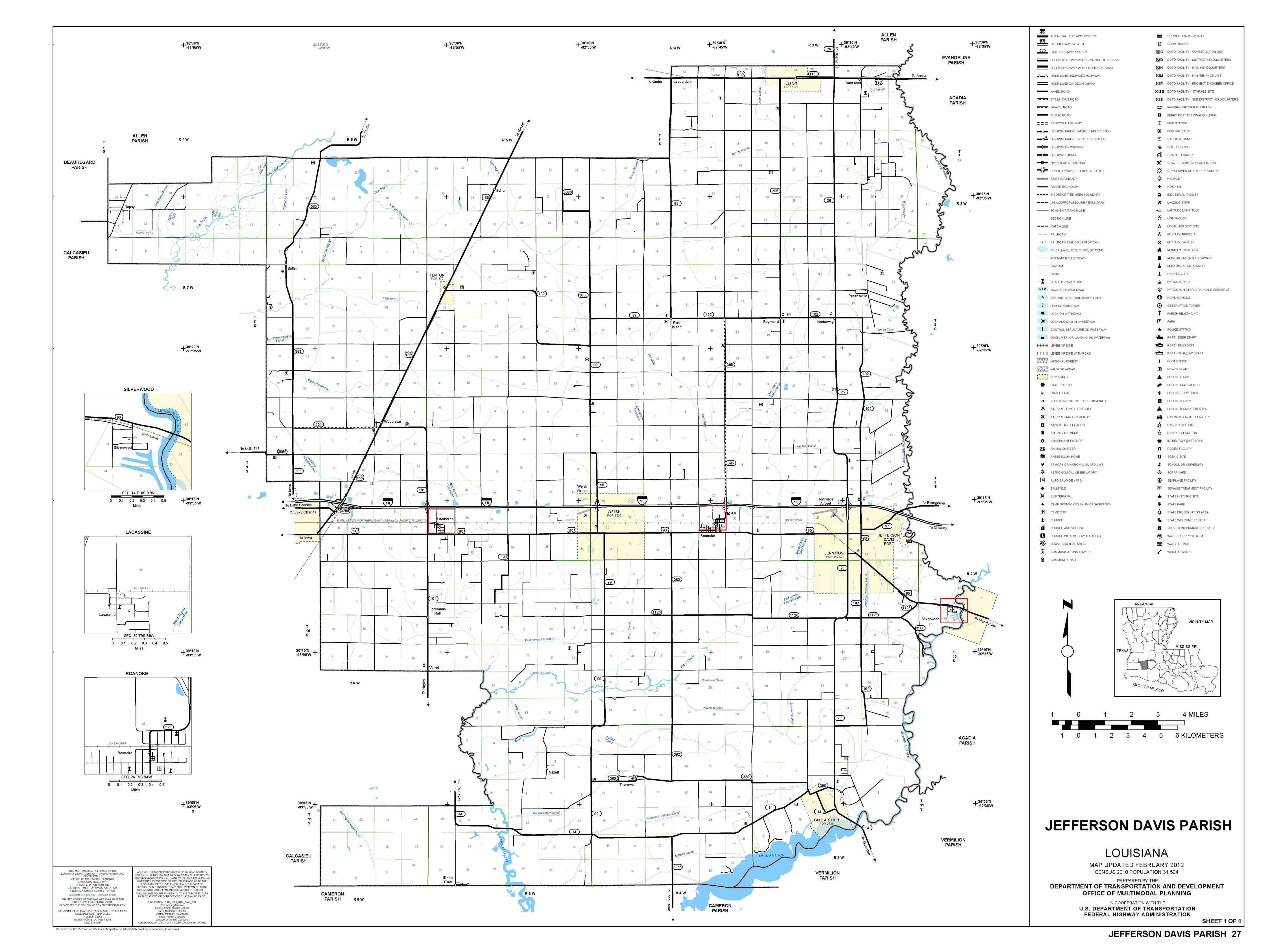

Tax Division Jefferson Davis Parish Sheriff S Office

Few Increases For 2019 Jefferson Parish Property Tax Rates So Far News Nola Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills